How I made $210,822 selling a pdf and a video on the internet

I have two info products on the market:

- The Good Parts of AWS — A 173 page PDF, released on Dec 25, 2019 (with pre-orders since Oct 3, 2019).

- Everyone Can Build a Twitter Audience — A 100 minute video, released on Apr 22, 2020 (with no pre-orders).

These two products made $237,207 in sales so far, and $210,822 in profit, for an average profit of $24,802/month. The AWS product took about 160 hours to produce, while the Twitter product only took 16 hours. But in this business, creating the content is generally the easy part. Finding customers is the bigger challenge. I've seen many creators succeed with various approaches, but I'm only familiar with one. And it goes like this: You find something you know really well, and you give everything you know about it for free. You do it on social networks, forums, and wherever people interested in your topic hang around. If you manage to get some attention, you will inevitably start getting questions, and these questions become your market research. You start answering the best way you can, and whatever doesn't fit in a short response becomes an opportunity for an info product. Then, if you choose to do the product, you'll have an audience to promote it to — an audience who already told you it wants to learn more about the topic, and that it wants to learn from you specifically.

But how big should your audience be for this to be viable? I don't know unfortunately. The fate of your products will depend on many things, but if you have an audience that's asking you questions, I'd say the odds are in your favor.

So, let's dig into what happened since I put my first info product on the market. First, let's take a look at my audience size:

I had a bit over 12,000 Twitter followers when my first product went on the market. Directly or indirectly, every dollar I made in this business can be attributed to this initial audience. I could have created the same two products before I had an audience, and I'm almost certain I wouldn't have sold any. The initial success brought with it all the future success through testimonials and word of mouth.

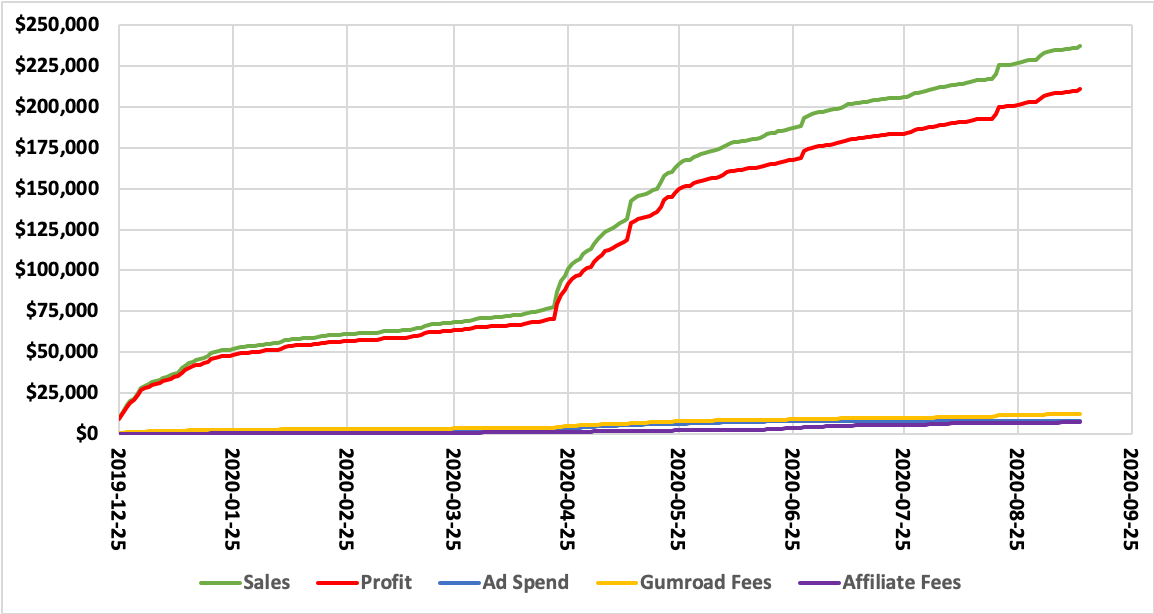

So, let's take a look at how the business grew since that launch:

There seems to be a correlation between my audience size and revenue, but this relationship is more complex than it seems. New followers seem to bring new sales, but new sales also seem to bring new followers. I don't try to read too much into this relationship, but I can confidently say that having attention is good for this business. And it's not the follower count that matters most — it's how many people know about you, and want your perspective. This is not easy to measure, but you'll know when it happens (you keep getting lots of questions).

So, let's jump into the performance of each product to see if we can learn something useful about how they were marketed. First, the AWS product:

We can see how there was an initial boost from the launch that lasted for about a month, and then sales stabilized at a steady rate. Then, there was another boost mid-March, partly because of a reduction in price, and partly from a new ad campaign (more on these later). That momentum has slowed down since, but it's still chugging along at a reasonable rate.

Now, let's look at the Twitter product:

This launch was very similar to the other product (about $40K in two weeks), despite having an audience twice as large (24K vs 12K followers). However, the Twitter product took off much better after the third week, and it settled at a much stronger steady rate.

Here's how both products compare on top of each other:

I had expected the Twitter product to have a bigger initial spike considering my larger audience at launch. Instead, the launch was almost identical, but its momentum has been significantly stronger compared to my first product.

I have some thoughts about what contributed to this dynamic. First, the Twitter product was sold at almost twice the price of the AWS product. Second, in hindsight, I think I set the launch price a bit too high for the Twitter product, which likely dampened the launch spike. In fact, after 3 weeks I reduced the base price by $10, and that appears to have untapped a large pool of demand that was likely reluctant to purchase at the original price.

Take a look at how the average sale price changed over time (below), and how it affected the sales volume (above):

For now, ignore those two big drops (we'll analyze that experiment later on). This chart shows my attempts at tweaking prices over time to try to find new demand. With the AWS product I started low and went high, then went low again. With the Twitter product I started high and kept going lower. My general takeaway from all this experimentation is that optimal pricing for consumer products is almost all about psychology, and what seems rational might not be very effective. Let me explain.

In theory, the best way to maximize profits from a digital product is to start with a high price and lower it over time. This is very common with movies. Disney just released Mulan last week for $30. After a few months, it will likely be on Amazon Video for $15, then a few months later you'll be able to rent it for $5, and then a year or two later you'll likely find it for free on Netflix. I tried to follow a similar approach with my second product, but I misjudged the psychological aspect. Basically, it's tough to get $100 from your most loyal fans, and then go promote the same product at $50 a few weeks later. If I were to start all over again, I would price the Twitter product between $35 and $45, and I suspect it would have done much better in that range. But even with this knowledge, now I'm reluctant to drop the price drastically because I'd have to promote the price change to the same audience that includes thousands of my most supportive customers who paid the original price, and I think that could be a short-term gain, long-term loss. (PS. Steve Jobs faced this exact problem when he dropped the price of the original iPhone after just 2 months.)

With my first product, I went the other direction. I took pre-orders at $24, then launched it at $28, and then increased it to $38 after a month. However, the $38 price appeared to meet some resistance, and the product lost some momentum. Then, the COVID pandemic hit in mid-March and I took that as an opportunity (and an excuse) to reduce the price to $15. This resulted in a significant second boost, which helped generate momentum from new word of mouth that has carried on until now.

I have no specific advice on pricing, and I only have experience with consumer products. (Info products sold to businesses can likely command different prices.) However, after 261 days in this business, my inclination is to err on a lower price at launch, and make it up in volume. Selling more units at a lower price has highly beneficial side-effects, including being easier to do, better reviews, better customer satisfaction, fewer refunds, and most importantly the multiplicative effects of increased worth of mouth. In this business, selling 100 products for $1 each is a lot better than selling one product for $100, because in the first case you'll potentially get 100 people promoting your product for free.

The chart below shows what I think is the opportunity I missed with my Twitter product:

Note how the AWS product sold significantly more units throughout its lifetime (excluding the recent spike), despite my audience being about half the size. Also, based on the engagement I get, I'm convinced that my audience is more interested in Twitter than AWS. My conclusion is that the Twitter product could have sold significantly more units than my first product if I priced it lower, and it would have likely made more profit through larger volumes and increased word of mouth.

Okay, now let's look at that extreme spike from last month. This was the result of a tweet where I announced a 1 hour promotion where anyone could get my products for any price they wanted, with a $1 minimum. The tweet was seen over 150,000 times, and it generated almost $8,000 in revenue from 2,559 sales. This is obviously not something I can do again any time soon, but it seems like it worked as a one-off promotion. My concern was that this would eat revenue from customers that would have likely bought at full price in the future (and I'm sure there was a bit of that), but the benefits from getting the product in the hands of thousands of new people appears to have countered that downside. Both products continue to sell at their regular rate since that promotion ended.

Also, note how the Twitter product sold twice as many units as the AWS product through this promotion, despite both getting equal treatment from me. I think this is more evidence that there's significantly more interest in the Twitter topic within my organic reach.

Next, we're going to look at another marketing experiment I tried with the AWS product:

I started experimenting with paid ads back in January, but I gave up very quickly. First, I couldn't find a reasonable cost-per-click rate amongst the popular advertising platforms, except for Reddit. On Reddit, I was able to show an ad in the r/aws sub for about $0.50/click. It started quite promising, but after a few days it was barely breaking even so I decided to stop. Then when the COVID pandemic hit, I heard that advertising rates were plummeting so I decided to give it another go. This time I was able to show my ads for just $0.10/click and the initial results were excellent. I kept tweaking things to try to find more availability at higher CPC bids, but eventually the rates became competitive again around mid-June and I was struggling to break even. If I had more time to invest in paid ads, there's likely more opportunity there, but for now I chose to invest my time elsewhere and I stopped the campaign.

The following is the chart I was watching on a daily basis to assess my ad performance:

Finally, I want to show you some of my top performing sources of direct sales.

- $20,015 — The announcement tweet for my Twitter product.

- $16,659 — The announcement tweet for my AWS product.

- $13,734 — The Reddit ad for my AWS product.

- $13,438 — This tweet where I first discounted the base price of my Twitter product by $10.

- $12,303 — The Gumroad link in my Twitter bio.

- $9,326 — My personal website, which gets almost all its traffic from my Twitter bio.

- $8,849 — Another tweet mentioning the $10 price discount.

- $7,868 — The pay what you want tweet.

- $6,615 — Another tweet mentioning the Twitter product.

- $6,367 — The email announcing the release of my Twitter product to 880 people on the list.

- $5,159 — A post on Hacker News where I shared some stats from my AWS product launch.

Thank you for reading, and I hope you found this useful. If you have any questions, ask me anything and I'll try to give you my best answer. 🙏

Key Account Manager eCommerce | StanleyBlack&Decker | Women & Tools 🛠

1y💡 Emilie Deville très très cool cet article

humanites teacher, hod at kalibu academy blantyre malawi

3yAn inspiring expose, I plan to launch an academic website, I have picked some idease on promoting infoproducts. any very experienced elaerning consultant out there, please contact me on mozesi@protonmail.com

Pretzel Logic

3yThanks for sharing. Do you use anything particular to keep track of all the statistics?

Congrats Daniel.